In 2022 there was a general increase in production costs around the world, with an increase of 20% for concentrated feed, 51% for fertilizers and 107% for energy. The Covid pandemic and the emergence of regional conflicts brought an environment of extreme uncertainty and inflation. Global demand for dairy products grew by just 0.8%, equivalent to population growth.

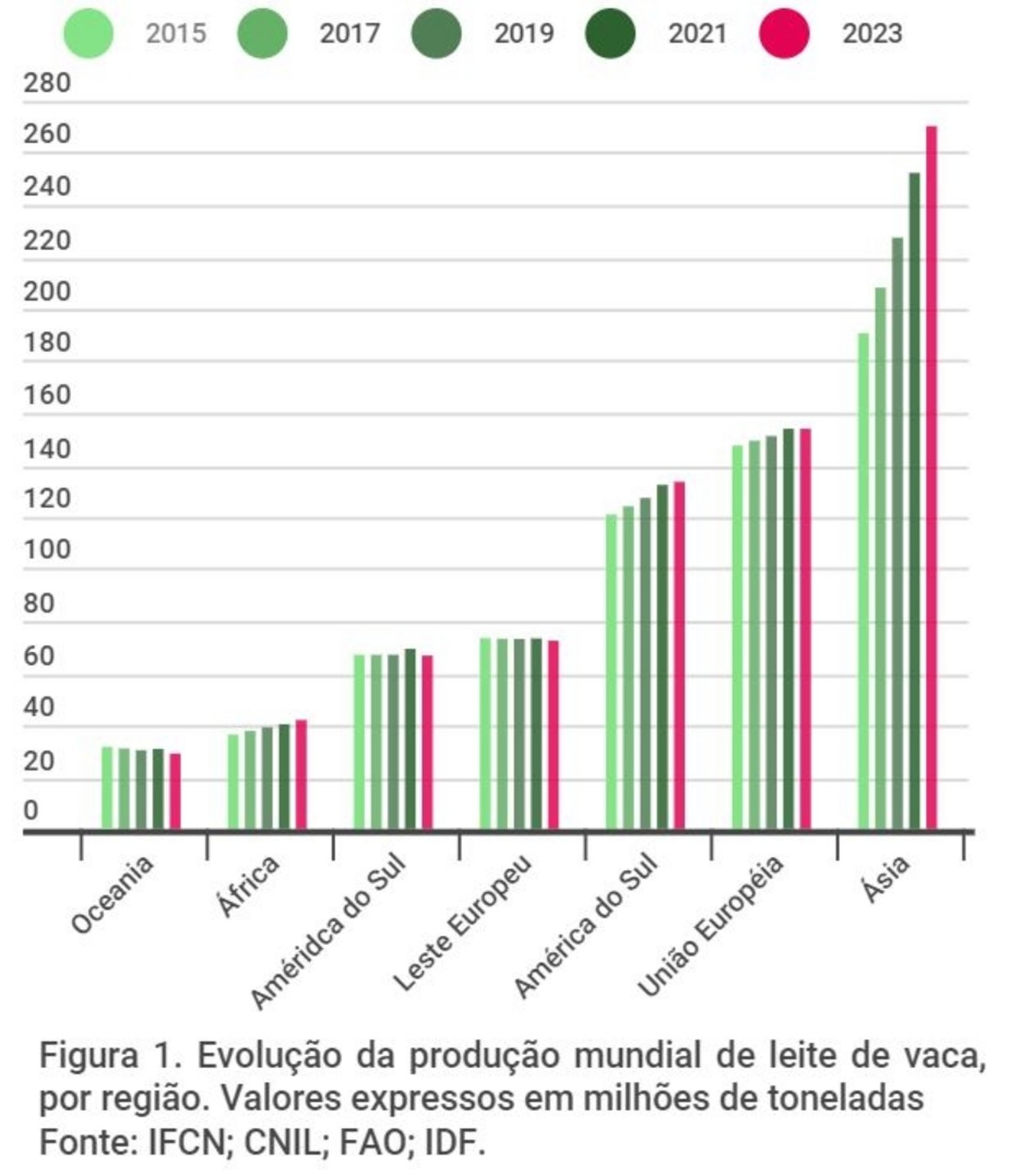

In 2023, global demand for dairy products remained weak, with a reduction in Chinese imports and a drop in the price of dairy products. Only at the end of the year was there a small recovery in prices, but still below US$ 0.40/kg of milk, as a reference for the average global price of milk paid to producers, according to the IFCN. In regions traditionally important for milk production and exports such as the European Union, Eastern Europe, South America and Oceania, stagnation or reduction in production has been observed in recent years.

Milk supply evolved positively in emerging regions with more informal production, such as Africa and Asia. In the world, 758 million tons of cow's milk were produced in 2022. Asia accounts for a third of world production, with 260 million tons. On this continent, milk production has grown 4.3% per year, on average, since 2010. The greater increase in consumption on the Asian continent, the lower labor cost and resilience of some traditional production systems may explain this significant increase in milk production (Figure 1).

India has 69 million small producers, where informal dairy activity predominates and productivity is below 2 thousand kg/cow/year. Half of the milk produced in India comes from buffalo herds.

China, which contributes 15% of Asia's production, is a country with a production structure distinct from others in the region. Just over 500 thousand properties, with a predominance of mega farms, with animals weighing more than 7 thousand kg/cow/year on average. The producer price was US$0.62/kg in 2022, one of the highest in the world.

Brazilian milk production has fluctuated at 34 million tons/year since 2013, creating a challenging situation of production stagnation. Less competitiveness compared to imported products is another obstacle.

In 2023, imports, mainly from Argentina and Uruguay, reached around 9% of the inspected dairy production in the country. The result was a record trade deficit of US$1 billion.

Throughout 2023 there was a small reduction in the cost of milk production in the country, with a slowdown in the price of concentrate, fertilizers and fuels. The cost of concentrated feed mix 70+30 was below R$1.50/kg, on average for the last half of 2023, back to the 2020 average level. However, the price paid to the producer also fell, impacting terms of trade and the profitability of livestock farmers, especially the smaller ones. These receive less because they produce on a smaller scale and have higher costs, compared to large producers. It was a difficult year for the entire sector in terms of profitability.

At the beginning of 2024, however, international prices continue to rise and domestic prices also signal an increase, both in the Spot and wholesale markets in the city of São Paulo. The expectation is that there will be some recovery in producer prices in the coming months. However, it is prudent to observe the evolution of costs in the face of climate uncertainties inherent to the grain harvest and silage production.