Here are highlights from the latest cereal and oilseed estimates reports published by the USDA on January 12:

Corn

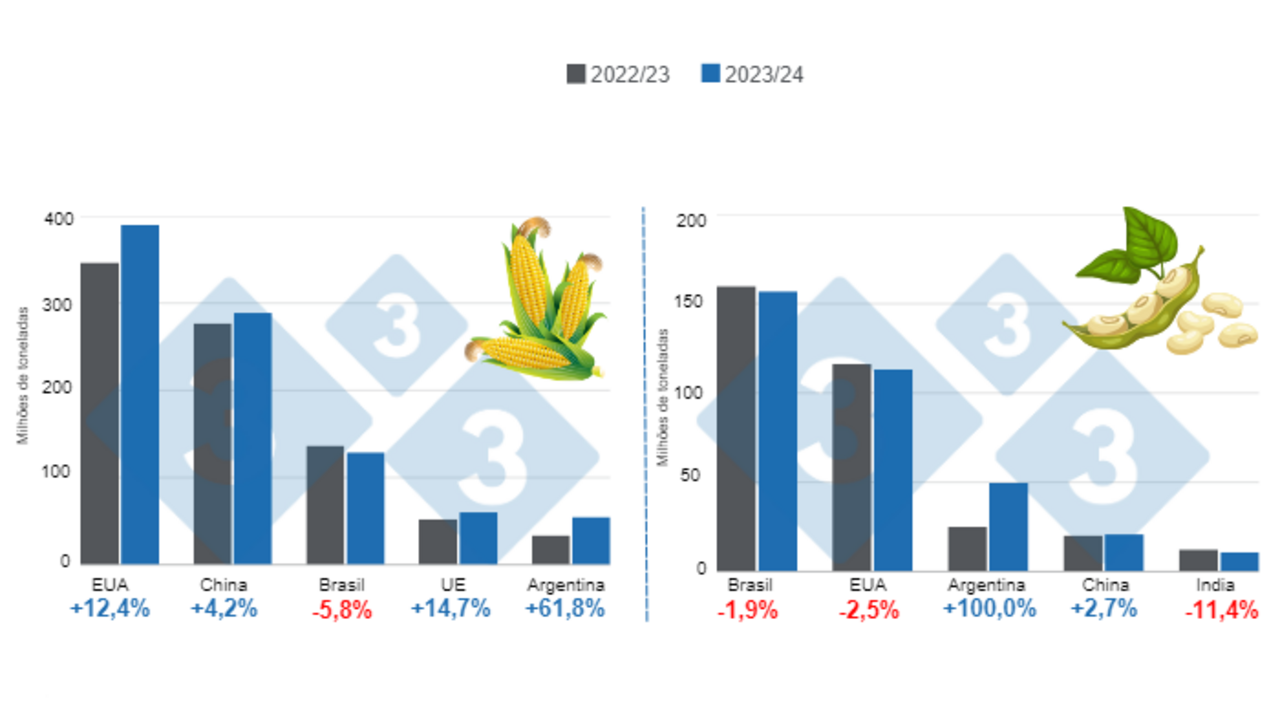

World corn production for the 2023/24 harvest is expected to reach 1235.7 million tonnes (Mt), an increase of 6.9 percent compared to the 2022/23 season (1155.6 Mt).

For the United States, production would be around 389.7 Mt, an increase of 12.4% compared to the previous season (346.7 Mt), while China would increase its harvest by 4.2%, reaching 288.8 Mt. For its part, the European Union would grow 14.7% with 60.1 Mt, while Ukraine, with 30.5 Mt, would show an increase of 13.0%.

For Brazil, production would reach 129 MT, which would represent a decrease of 5.8% compared to the previous season, while for Argentina, the harvest would reach 55 MT, an increase of 61.8% compared to the previous season. previous.

World grain exports would increase by 11.1%, going from 180.8 MT in the 2022/23 season to 200.9 MT in this new cycle, with the United States being the second largest exporter of the grain with 53.3 MT, which would mean an increase of 26.4% compared to the previous season.

The exportable supply from South America would show a significant increase on the part of Argentina, as it would increase 78.3% in this new cycle, with 41.0 million tons, while for Brazil an estimated 54 million tons, which would represent a decrease of 5.3% compared to the previous season.

China would require corn imports of 23 million tonnes, which means an increase of 22.9% compared to the previous season (18.7 million tonnes), while the European Union would import 23.5 million tonnes, or that is, 1.5% more than in the 2022/23 season (23.2 million tons).

Final stocks would increase by 8.2% worldwide, to 325.2 Mt. In fact, for the United States, stocks would increase by 58.9%, while for Brazil they would decrease by 32.1%.

Soy

World soybean production for the 2023/24 harvest would increase by 6.3% compared to the previous harvest, from 375.4 to 399.0 million tons.

Estimates for harvests in South America show a decrease of 1.9% for Brazil, which would reach 157 Mt, while Argentina is expected to increase 100.0% with 50.0 Mt.

Paraguay would increase its production by 5.6% compared to the 2022/23 season (9.8 Mt), reaching a harvest of 10.3 Mt.

In this new report, a harvest of 113.3 Mt is estimated for the United States, which refers to a decrease of 2.5% compared to the 2022/23 cycle, when it reached 116.2 Mt at that time.

Export activity would be led by Brazil with 99.5 MT, growing 4.2% in relation to the previous cycle (95.5 MT), while the United States would reach an export volume of 47.8 MT, a value that represents a decrease of 11.9% compared to the last harvest (54.2 MT).

For Argentina, exports are projected at 4.6 million tons, which would mean an increase of 9.9% compared to the 2022/23 season (4.2 million tons).

China would import 102 million tons, 1.1% more than in the previous campaign.

Global oilseed ending stocks would increase by 12.5% to 114.6 million tonnes, supported by increases in stocks in Argentina, China and Brazil.

Editorial 333 Latin America with data from USDA | U.S. https://apps.fas.usda.gov/